USDA Design Fund getting Strengthening a different sort of Household

An excellent USDA framework financing is a type of financial considering compliment of the us Agency out-of Farming (USDA). This type of funds are created to let some body inside the rural components finance the development out of a different home with USDA-backed funding from the Solitary Family members Domestic Protected Loan Program.

Regardless if you are just starting to mention your options or you will be in a position so you’re able to plunge to your application techniques, this informative guide will provide you with an obvious comprehension of exactly how USDA design finance work as well as how you can influence all of them to bring your ideal where you can find life. We will walk you through just what USDA structure finance is actually, as well as key has actually, criteria, and you will advantages and disadvantages; next, make suggestions new tips in order to safer good USDA build loan to help make your fantasy household.

Single-Personal Funds

Probably one of the most simpler popular features of USDA structure finance was they are solitary- or one-time-personal money. Thus the loan procedure are simplified to your you to app and one closing processes for the construction phase in addition to last financial.

For some almost every other financing applications, building a different household demands several financing: you to to your build stage plus one to the mortgage just after your house is created. Each one of these finance need certainly to go through the closure processes privately.

Although not, with a beneficial USDA single-intimate design financing, individuals just need to look at the closure processes immediately after. It not just conserves some time decrease documentation and also reduces closing costs.

Construction-to-Long lasting Loans

Having non-USDA construction fund, the brand new changeover on the first design mortgage in order to a permanent mortgage might be advanced and you will costly. However, USDA single-close construction money are created to efficiently transition from the build stage into the long lasting home loan without needing extra loans or refinancing.

USDA structure-to-permanent money mix a casing mortgage having a classic USDA mortgage in one mortgage. As soon as your new house is accomplished, your own build loan tend to instantly change so you can a timeless 31-year fixed-rate USDA mortgage.

Design Financing and no Money Off

Probably one of the most remarkable top features of USDA build financing was the capacity to funds your brand-new family build and no off percentage. This really is a rare brighten versus most other structure finance since the old-fashioned loan providers commonly require a life threatening downpayment to own a larger upfront costs.

USDA Build Mortgage Standards

As with any USDA financing, the fresh new homebuyer must satisfy money and qualification conditions, while the possessions should be inside an effective USDA-accepted venue. But not, certain a lot more fine print exists, including:

- Our home suits most recent IECC, otherwise further password, for thermal conditions.

- The brand new homebuyer need found a different sort of build warranty on the builder.

- One continuously money from the construction need certainly to wade yourself on new mortgage principle.

- Money ily home, are made family, or eligible condominium.

USDA Acknowledged Contractors

The brand new USDA necessitates that the lending company approve any designers otherwise designers you wish to have fun with. Into the contractor or builder to-be entitled to make your household utilising the USDA mortgage, they have to:

- Have no less than a couple of years of experience strengthening unmarried-family members home

- Furnish a property or company permit

How to get good USDA Construction Loan having Home building

If you’re considering a good USDA single-close structure financing, here you will find the actions you should realize to improve your chances out-of approval and ensure a silky experience.

step 1. Research Loan providers Who Provide USDA Design Loans

The first step is to get a loan provider that gives USDA structure financing. Because these loans try less common, contrasting lenders may need a little extra effort.

Start by contacting banking institutions and credit unions in your area, since they’re prone to be aware of certain requirements of the regional communitypare the services, rates of interest, and you may costs out of several lenders that provide USDA build fund so you can find the best matches to suit your finances.

2. See good USDA-Approved Company

Once you’ve a loan provider in mind, the next phase is to choose a company or builder which is approved because of the USDA. This is important, while the an approved builder are a loan requisite.

Your financial may provide a list of recognized builders, or you can contact this new USDA yourself having recommendations. Make sure that your chose specialist has experience inside the completing methods one satisfy USDA criteria and rules.

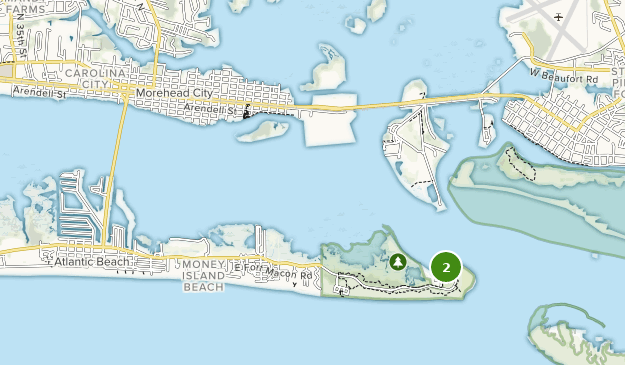

3. Find End up in an excellent USDA-Qualified Urban area

Before you can go-ahead, you need to safer a block of land from inside the a place that is qualified to receive USDA resource. USDA money are intended to market growth in rural portion, and so the property need see certain location conditions to help you qualify for an effective USDA build financing.