Conventional finance are an effective way to finance your residence strategies

To invest in a house is a significant monetary decision that needs enough planning. But with a wide variety of brand of mortgage loans, with exclusive conditions and you may pricing, it could be difficult to learn which is the proper choice for you. They give flexible terminology and reasonable-rates of interest. But not, such things, there are also cons to these financing.

Thus let’s consider everything you need to see about old-fashioned financing-of how they work to their advantages and disadvantages, and you will what’s the best method to make use of.

What exactly is A normal Loan?

A normal mortgage is actually a home loan that isn’t government insured. Alternatively, its available courtesy loan providers, like banking institutions, agents, borrowing from the bank unions, and you will home loan organizations.

When you find yourself government-insured and you can regulated money like FHA, Va, and USDA is actually at the mercy of specific guidance, old-fashioned finance possess their financing terms and conditions, including qualification conditions, rates, down payment standards, and you may commission dates.

Conventional mortgages are definitely the typical kind of a mortgage option. Aside from providing flexible costs, they give buyers having a wide a number of possibilities. Predicated on good You Census Bureau survey, antique mortgages be the cause of more 76 % of brand new home sales.

Yet not, despite their freedom, conventional money be a little more challenging to qualify for. When comparing to bodies-insured fund, lenders face greater dangers regarding the borrower standard. And therefore, prospective individuals need to reveal high credit scores with a minimum of 620, have a good credit rating, and also have a personal debt-to-income ratio regarding within very extremely 50% americash loans Autaugaville in order to qualify for the mortgage. We’re going to go into the info soon.

Just how a traditional Home loan Functions

Old-fashioned home loan applications might take months to track down very first accepted. As with any home loan, there’ll be enough paperwork and you may help situation you to definitely you have got to get ready to increase recognition. But not, once you learn what you are carrying out beforehand, it’s easier.

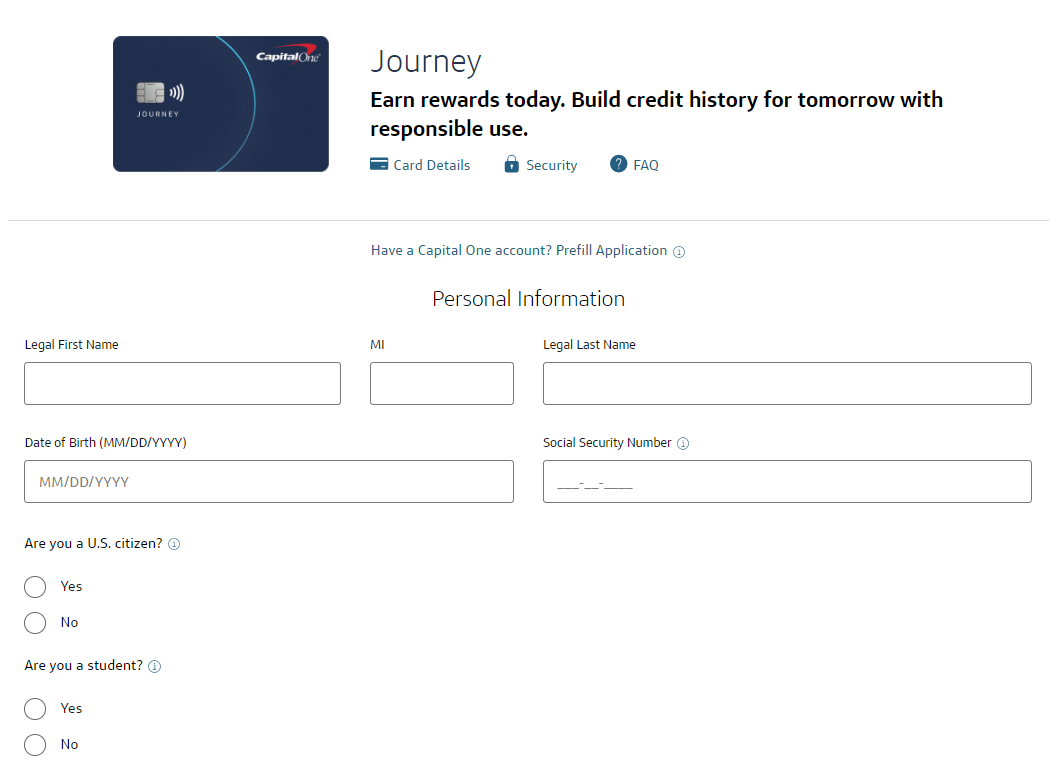

Delivering Licensed

A loan provider generally speaking demands relevant economic data files and suggestions such as for instance a legitimate technique of identity, financial statements, recent shell out stubs, papers proving how you would afford the downpayment, and in some cases the tax statements. It is so you’re able to approve you have a stable money and are able to afford a month-to-month mortgage payment.

Providing Approved

To possess a conforming antique loan, you can get acknowledged which have a credit rating of 620. But this can be largely influenced by the lending company. Its imperative for a score out-of a 660 or a lot more. If not, an enthusiastic FHA loan might possibly be a much better option.

You truly need to have a reliable earnings, getting for the restrict greeting personal debt-to-money proportion, while having a good credit score. You should also have sufficient offers to cover the closing costs, put aside, and downpayment (The down payment often include step 3% to 20% of one’s purchase price according to your specific condition.

Deposit

Loan providers need a downpayment regarding as low as 3% having repaired-rate funds and you can at least 5% to own Fingers (Adjustable-Rates Mortgages). However, because lenders are at chance for individuals who default, you need to spend Private Home loan Insurance (PMI) if you put below a beneficial 20% downpayment. Although not, new PMI is canceled if a citizen enjoys amassed 20% equity in their house – with no need of a good re-finance.

Brand new PMI will set you back vary mainly based your credit score, amount of consumers towards financing, as well as your financing so you can value ratio (just how much your own down-payment was). Because of exactly how many details, the newest PMI can cost you can basically be ranging from 0.15% and you may 2.5% of your own loan annually. The bigger the down-payment, the greater. Needless to say, a deposit of at least 20% of the property rates does away with requirement for individual financial insurance.