You could potentially submit an application for your HELOC by way of a financial, borrowing connection otherwise non-bank financial, dependent on your position

Certain experienced homeowners will use an excellent HELOC to pay towards the an excellent higher get back, provided the eye pricing are reasonable. It may also supply the very first resource to possess carrying out a corporate, but this should be reached having caution. “The new security you own of your house try a secured item and you will, for the majority residents, an overlooked chance whenever they aren’t leverage it,” Kinane says. However, unless you’re certain of new come back and incredibly proficient in assets, it might not feel worth the chance to your residence.

A HELOC are often used to consolidate personal debt with high notice prices, particularly credit debt, auto loans or any other debts. not, its vital consumers contemplate their house has started to become at stake. “That have a good knowledge of the money you owe is an accountable action for taking when obtaining any sort of credit, should it be a credit card, auto loan otherwise HELOC. Dictate your unique personal disease and you can a lot of time-name requires about a great HELOC,” Kinane claims.

Going for a loan provider

There’s absolutely no set quantity of loan providers which have the person you is always to inquire, but consider, prices are incurred for each app you really have canned. You should discovered a reality-in-Credit disclosure away from for each and every bank, and value comparison should include brand new ount funded, financing charge and extra costs. The amount funded is not necessarily the complete number of the guarantee, but alternatively the price without fees and you will repayments (that’s believed because of the HUD as part of the loans costs and you can Apr calculation).

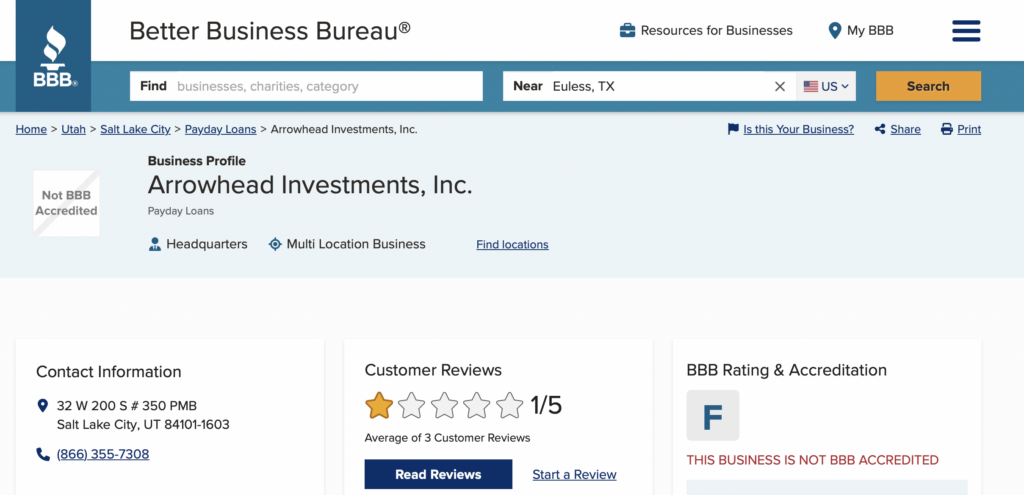

Banking companies usually run borrowers who’ve a credit rating of 750 or maybe more, whereas borrowing unions and low-financial loan providers are far more lenient. Banking institutions also tend to romantic reduced and supply lower basic prices, which may balloon over time. The option of which profit your own HELOC are private and must feel centered on your circumstances and you may which establishment provides you an informed pricing.

“HELOCs are advertised while the that have lowest costs for beginning her or him up,” states Reiss regarding Brooklyn Rules University. “Those people prices are important, you would also like in order that the pace are competitive as you may save very well the expense and you can following easily reduce men and women savings and more toward desire. Does the lending company need you to withdraw a specific amount out of new HELOC for a lot of time, and therefore making you accrue desire even although you do not need the bucks right away? Does the lending company costs any sort of repair fee? Comparison shop and you will contrast the newest APRs of the HELOCs you are considering.”

Eventually, doing your research experts the consumer. “People wanting HELOCs need to look for a loan provider who can protected the current reasonable cost against most of the, or a portion, from what they borrow off their credit line,” claims Kinane from TD Bank. “HELOCs ought to provide customers that have monetary autonomy, therefore like a lender just who also provides several and you may easier a method to borrow against or reduce the credit line.”

Applying for an excellent HELOC

Of a lot residents try pleased to discover app processes having an excellent HELOC isn’t as demanding due to the fact mortgages. Bringing approved to have good HELOC might be shorter than obtaining a mortgage. Your application will include:

- A done application for the loan

- A finalized Borrower’s Agreement to produce Guidance form

- One or two years’ property value W-2s otherwise tax returns

- Several years’ property value Schedule K variations when you are self-operating

- Bank comments

- Other house information, such financial support profile and you can retirement possessions

- All of the loan places Steele information pertaining to any a property which you very own

- Details about a good bills for the possessions, as well as your home loan company