What is the Difference in an effective Pre-Approval and a great Conditional Pre-Recognition?

How to Guess Home loan Pre Recognition

Before you could discovered finally acceptance having home financing, you’re going to have to obvious some other recognition difficulties. Their pre-recognition shall be with good conditional pre-acceptance, and thus you’re going to have to meet particular conditions prior to the lender gives this new green white to the finally financial acceptance. Even before you start navigating the latest twists and you may converts one to means the fresh new recognition maze, everything starts with the applying processes.

TL;DR (Too much time; Didn’t Comprehend)

Home financing pre-acceptance, that is a preliminary mortgage recognition, is the step just before an excellent conditional pre-approval, and this outlines the fresh conditions a borrower need meet before bank or underwriter is grant finally approval.

Financial Software Action

Because the a predecessor to mortgage recognition, the loan app also provides a lender sufficient suggestions to begin with towards the you to definitely objective. A few of the information your offer on the application helps this new financial flow you in direction of certain types of finance in which you get meet the requirements, and you can off most other fund, that may not be around. As bank assesses debt fitness by looking at the money, a career and debt suggestions your fill out, the lender could possibly get offer good pre-approval considering which first comparison.

Home loan Pre-Recognition Step

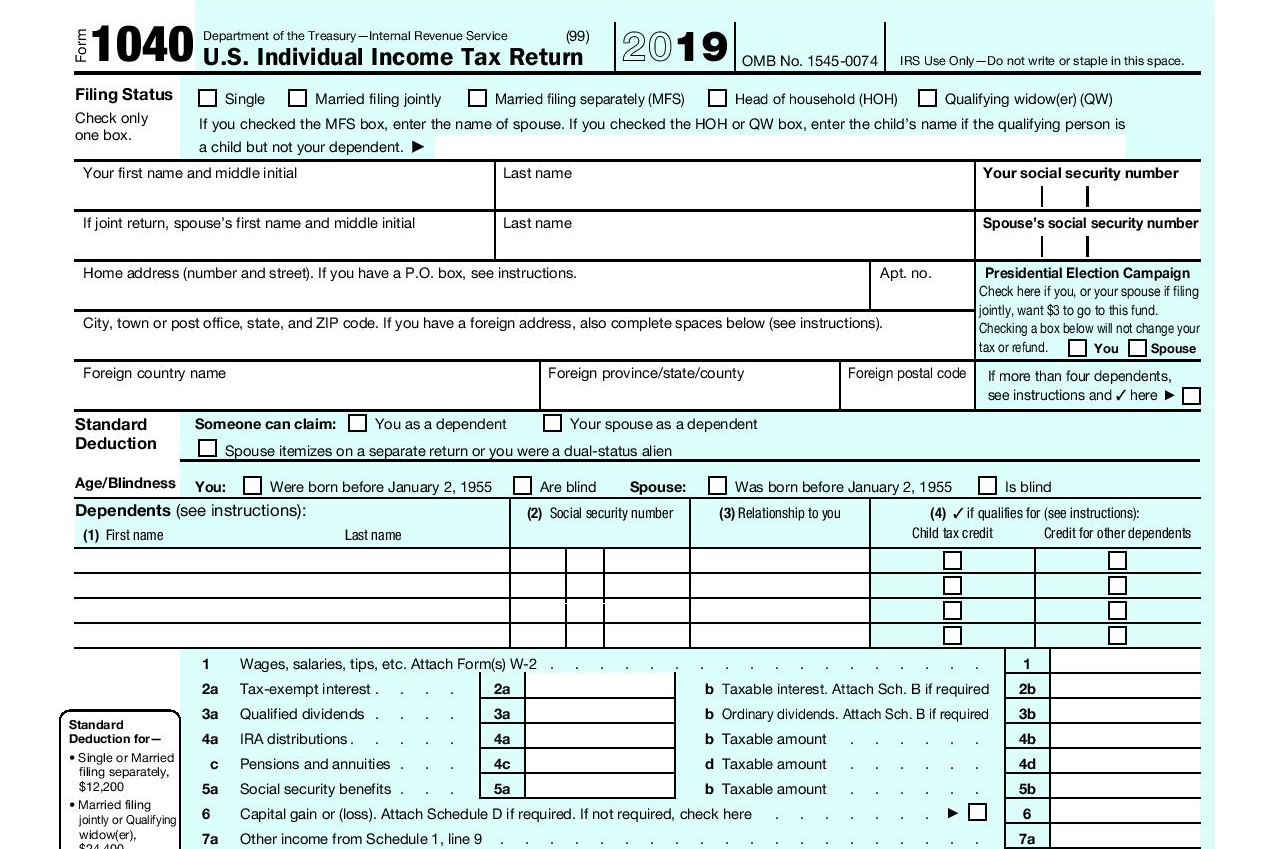

Shortly after a lender crunches the newest quantity on your app such as your income and debts while some thing research positive, the job status changes into the pre-recognition status. During this step, the lender often remove your credit report, and you will need supply the documents you to hold the financial studies your listed on the job. Certainly one of almost every other records that start populating your own real estate loan document, the current pay stubs and you will tax statements have a tendency to be sure your own money, and your boss usually make sure your own work into a type expected because of the lender.

Conditional Pre-Recognition Step

After you’ve introduced the latest pre-acceptance step following bank features, on top of other things, affirmed their work, appeared your credit rating and you will confirmed your income and a career you will end up managed to move on toward conditional pre-approval step. At this juncture, you are just one step out of finally acceptance. You will be generally recognized on financial, pending the satisfaction away from conditions called requirements. Types of requirements are the stipulation that you must offer the most recent home before you buy your house, you ought to pay-off (or lower) a financial obligation otherwise give most documentation.

Conference the latest Conditions

Once you have acquired a great pre-recognition, the lender can provide you an effective conditional qualification letter, which cards your own eligibility for certain financing services listing this new standards you’ll want to see to possess latest recognition. In addition to verifying your income during the pre-certification, the lender could need to file the main cause of your down payment for the conditional pre-acceptance.

If, such as, you may be researching the income to suit your downpayment out of a household affiliate, brand new lender’s underwriter ily member so you’re able to document it import. And because one last acceptance is additionally based on an assessment and/or house check that come back certain show, these all-important files might also want to meet up with the lender’s finally standards.

Assertion from good Conditional Pre-Recognition

If you can’t meet up with the standards outlined on your conditional pre-acceptance, you could flunk from a last approvalmon reasons for having doubting good conditional pre-approval range from the discovery regarding an unexpected lien toward possessions, the inability of lender’s underwriter to confirm the info otherwise help records with the mortgage software or issues with the new https://paydayloanalabama.com/mcmullen/ appraisal otherwise house inspection report. But even when the underwriter directs the conditional pre-approval to the lending company once the a denial, you might still manage to match the standing(s) concerned because of the giving the called for paperwork otherwise fulfilling any deficiency.